While the U.S. Donald Trump administration and the Chinese Xi Jinping government are intensifying their tariff war, the situation is not necessarily in favor of the United States. This is because U.S. financial markets have plunged into turmoil. Prime Minister Shigeru Ishiba of Japan, the largest investor in the U.S., should immediately stand by the Trump administration and offer financial cooperation with the U.S.

China taking a strong stance in the tariff war

President Trump has hit U.S. allies and adversaries alike with steep tariff hikes. On April 9, however, Trump announced a 90-day pause on reciprocal tariffs for Japan and many other U.S. trading partners for bilateral negotiations while implementing a 145% tariff on China, indicating that China is a main target for his tariff offensive. The Xi government immediately responded with a 125% retaliatory tariff on the U.S. As tariffs exceeding 100% are likely to make trade business unviable, a deal will naturally be required. However, Chinese President and Communist Party General Secretary Xi has turned his back on Trump’s attempts to engage in dialogue with China.

The Chinese side can take a strong stance because U.S. financial markets have gone wild. The U.S., which is the world’s largest debtor country, plunges into economic difficulties unless massive foreign funds flow into the U.S. to more than offset the U.S. current account deficit worth more than $1 trillion including the trade deficit. Over the past several years when the U.S. dollar remained strong with U.S. stock prices rising, this U.S. weakness did not surface. However, the U.S. faced a triple decline in the dollar, stocks, and Treasury bonds as the Xi government came up with retaliatory tariffs and a trade embargo on rare earths on April 4. While Trump suspended the high reciprocal tariffs on U.S. trading partners other than China, Treasury bond selling was continuing on April 11. U.S. Treasuries are essentially the last resort for foreign investors. Given that a Treasury price collapse means a U.S. selloff, even the bullish Trump has started to feel the pressure.

The Xi government seems to be confident that China can withstand a protracted tariff war with the U.S. China, which is the exact opposite of the free-market U.S., has a system to fully regulate financial markets. It strictly limits capital outflows and control the fluctuation of the yuan through market intervention. The Xi government forcibly suppresses financial market turmoil.

Japan can buy and support U.S. Treasury bonds

Holding the key to stabilizing U.S. financial markets is Japan, which has the world’s largest external financial assets, mainly investments in the U.S. In 2020 when the world was shaken by the COVID-19 pandemic, Japan’s external investments and loans amounted to 90% of the U.S. current account deficit, contributing to stabilizing U.S. financial markets.

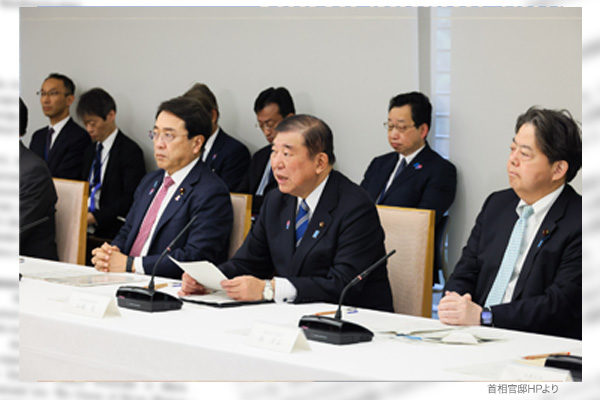

Ishiba plans to send his confidant, Economic Revitalization Minister Ryosei Akazawa, to the U.S. for tariff negotiations. But Akazawa, who has little to do with finance, seems unable to undertake tough negotiations to lead the U.S. to withdraw high tariffs in exchange for Japan’s financial cooperation such as flexible buying of U.S. Treasury bonds.

Hideo Tamura is a Planning Committee member at the Japan Institute for National Fundamentals and a columnist for the Sankei Shimbun newspaper.