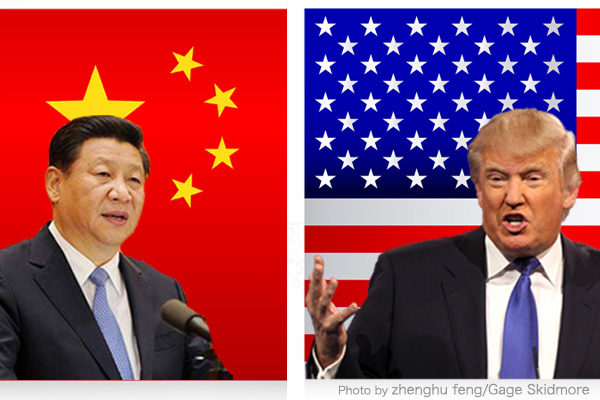

While a high tariff policy that the second U.S. Trump administration is expected to introduce after its inauguration next January has been criticized as being likely to trigger global financial market turmoil, its positive aspects should be properly evaluated.

China’s economic growth to plunge

President-elect Donald Trump has declared that he would impose additional tariffs of more than 60% on imports from China and more than 10% on those from other countries including Japan. He has also vowed to raise the additional tariffs on Chinese imports to 150-200% if China forces through a blockade of Taiwan.

How shocking would the 60% additional tariffs be to China? Economists at Swiss banking giant UBS expect that China’s gross domestic product growth would be halved, while the China research office of U.S. investment bank Goldman Sachs forecasts that China’s economic growth would fall by 2 percentage points. No wonder. A substantial portion of China’s economic growth is supported by its trade surplus with the United States. Investment in housing and other fixed assets, which accounts for about 50% of China’s GDP, plunged by 12% last year from the previous year and is continuing to stagnate this year.

China’s central bank, the People’s Bank of China, is cautious about quantitative monetary expansion, while the central government is hesitant to increase the issuance of government bonds. This is because capital flight is intense, with foreign direct and securities investment plummeting. In order to overcome the difficult situation, the Xi Jinping government will have no choice but to loosen market controls and take steps toward financial liberalization.

Market confusion theory is overemphasized

On the other hand, critics say the high tariffs would boost the average U.S. tariff rate to the level of the 1930s during the Great Depression and many Western financial market analysts warn U.S. inflation and interest rates would skyrocket. If so, the incoming Trump administration would not be able to enforce high tariffs.

However, we should not overlook that Trump has promised massive tax cuts, shouting “Make America Great Again.” Based on last year’s imports, additional tariffs of 60% on Chinese imports and 10% on other imports are estimated to boost U.S. tariff revenue by $256 billion and $268 billion, respectively. The total revenue increase of $524 billion amounts to some 80 trillion yen, more than equivalent to Japan’s annual general account budget revenue (72 trillion yen in fiscal 2023).

According to the Committee for a Responsible Federal Budget, a bipartisan congressional committee, Trump’s tax cut proposal would reduce tax revenue, increasing the U.S. budget deficit by about $4 trillion over 10 years or an annual average of $400 billion. Even if so, however, the increase in tariff revenue would more than offset such budget deficit expansion.

Since the additional tariffs are added to imported goods prices, American consumers would be directly hit. Nevertheless, the impact on them would be covered by various tax cuts. The combination of tariff hikes and tax cuts makes sense in economics. Isn’t the market turmoil theory overemphasized?

Hideo Tamura is a Planning Committee member at the Japan Institute for National Fundamentals and a columnist for the Sankei Shimbun newspaper.