On February 24, U.S. President Joe Biden signed an executive order mandating a review of supply chains for four critical products: computer chips, large-capacity batteries, pharmaceuticals, and rare-earth minerals. “We shouldn't have to rely on a foreign country, especially one that doesn't share our interests or our values," Biden said with China in his mind. Will the Biden administration take a tough attitude as did the previous administration?

The four critical products are also a matter of concern to the U.S. Congress. The executive order called for a 100-day review across federal agencies to address problems in the supply chains of the four key products and consider measures to be taken. As countermeasures have already been going on for computer chips and rare earths, the urgency of the executive order looks doubtful. We may have to check whether the order is designed only to demonstrate that the administration is tackling challenges regarding China or whether it would be accompanied by actions.

Japan-U.S.-Taiwan alliance eyed for computer chips

Japanese media conclude the review of supply chains as aimed at breaking away from dependence on China. But it is not right to make such conclusion for all the four products.

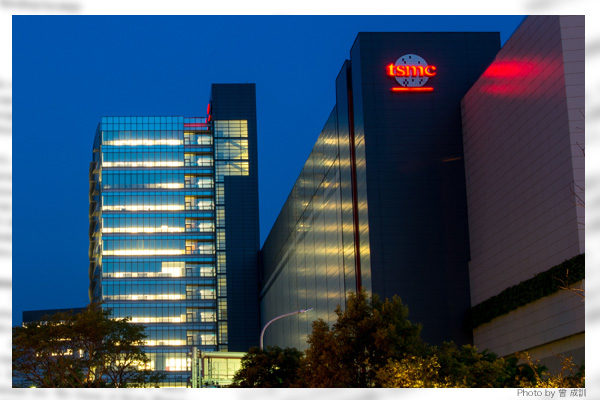

As for computer chips, China is desperate to raise its self-sufficiency as the low self-sufficiency is its weak point for China. In response, the U.S. is trying to secure its supremacy by enclosing computer chip supply chains within its camp including allies. In such effort, the U.S. has attracted plants of Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest contract chipmaker based in Taiwan, to Arizona. The Congress for its part has passed the National Defense Authorization Act of 2021 calling for establishing a multilateral fund for developing reliable supply chains of computer chips.

Japan has also invited TSMC to launch a joint semiconductor development project with leading Japanese semiconductor manufacturing equipment and parts makers. Japan, the U.S. and Taiwan have thus already taken measures to build semiconductor supply chains.

China eyes counteroffensive with rare earths

China that has a weak point with regard to semiconductors plans a counteroffensive in the rare earth field, as indicated by Chinese President Xi Jinping’s speech carried by Qiushi, a theoretical journal of the Chinese Communist Party, last October. Xi said in the speech that he would make foreign countries more dependent on China in the international industrial chain for rare earth materials and build strong counteroffensive and intimidation powers to oppose artificial cutoff of the industrial chain by outside forces.

Given that rare earths are used for military purposes, the U.S. is not standing idly by. It has been trying to develop rare earth supply chains that do not depend on China. The U.S. Defense Department has provided financial support for an Australian company to build rare earth refining plants in the U.S. Japan also supports rare earth supply chains as a key player with its technology to make high-performance magnets from rare earths.

Japan and the U.S. can cooperate in the field of batteries as well. For the Biden administration willing to accelerate electric vehicle diffusion under its decarbonization initiative, it is indispensable to cooperate with Japan with leading battery makers in breaking away from dependence on China for batteries as key EV device. Japan has started next-generation battery development, paving the way for cooperation in decarbonization.

Irrespective of the 100-day review, the U.S. has already begun cooperation with allies. The supply chain review provides a good chance for Japan-U.S. cooperation.

Masahiko Hosokawa is a professor at Meisei University and a former director-general of the Trade Control Department at Japan’s Ministry of Economy, Trade and Industry. He is also a Planning Committee member at the Japan Institute for National Fundamentals.