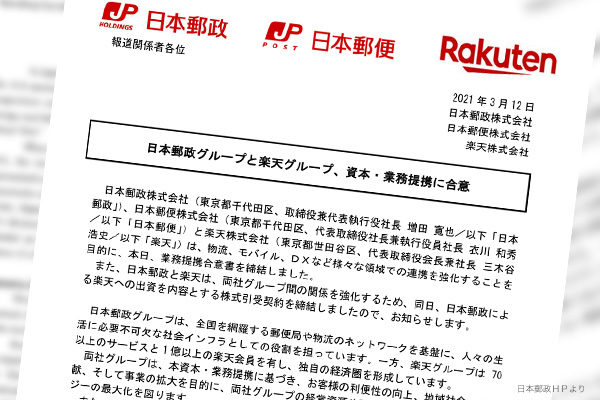

Japan Post Holdings Co. and Rakuten Inc. announced their equity and business partnership on March 12, sending a shock wave throughout Japan. In response to an equity share offer by Rakuten, Japan Post Holdings will invest 150 billion yen to acquire an 8.32% stake in the e-commerce firm. The two companies will enhance partnership in a wide range of business areas including logistics, mobile phones and financial services. From the business strategy viewpoint, the partnership could be appreciated as bringing about synergy effects. But we must not overlook serious problems behind the partnership.

Government-controlled firms’ investment must be fair

One problem is that Japan Post Holdings is a company in which central and local governments have a majority stake of 56.87%. Japan Post Holdings has postal, banking and insurance service subsidiaries. There may be no problem if these subsidiaries form partnerships with other companies. When the parent company that is dominantly owned by the government sector invests massive money in any private company, however, fairness is required. Only late last year, its postal service subsidiary Japan Post Co. announced a business partnership with Rakuten in logistics. Only two months and a half later, the parent company cut the equity partnership deal.

Through the equity share offer, Rakuten plans to raise about 240 billion yen from Japan Post Holdings and two other companies mainly for its mobile telephone services that would not benefit Japan Post Holdings. Japan’s Suga administration has promoted a campaign to cut mobile phone service fees, dealing a severe blow to Rakuten, which has been the latest entrant into the mobile phone services market. The Japan Post deal could be taken as a measure to rescue Rakuten. It is tantamount to pouring Japanese national’s assets into a specific private company.

Personal data could be leaked to China

The other problem is even more serious. Among the three new investors is a subsidiary of Chinese information technology giant Tencent Holdings Ltd. that will invest some 66 billion yen in Rakuten.

The previous U.S. Trump administration issued an executive order in its final days banning downloading of Tencent’s popular WeChat application and considered banning American investment in Tencent as a company closely linked to the People’s Liberation Army of China. Behind these actions was concern that personal data of American customers could be leaked to the Chinese government.

In China, conversations, movements and purchasing records of some one billion citizens are put under surveillance through WeChat. The Chinese communist regime has been enhancing control on Tencent as well as Alibaba Group Holding Ltd. through the anti-monopoly law and other means, and Tencent has vowed to cooperate with the Chinese government.

Tencent now invests in Rakuten and is considering collaboration with the Japanese company in online shopping services. Rakuten is Japan’s platformer not only for e-commerce but logistic services. Tencent should never be allowed to use its influence to affect the way to handle Rakuten-held personal data and logistics infrastructure. This is a grave problem related to Japan’s economic security. The Japanese government should understand the seriousness of the problem and make a responsible judgement. Those who follow matters only with business mind could fall into a big pitfall.

Masahiko Hosokawa is a professor at Meisei University and a former director-general of the Trade Control Department at Japan’s Ministry of Economy, Trade and Industry. He is also a Planning Committee member at the Japan Institute for National Fundamentals.