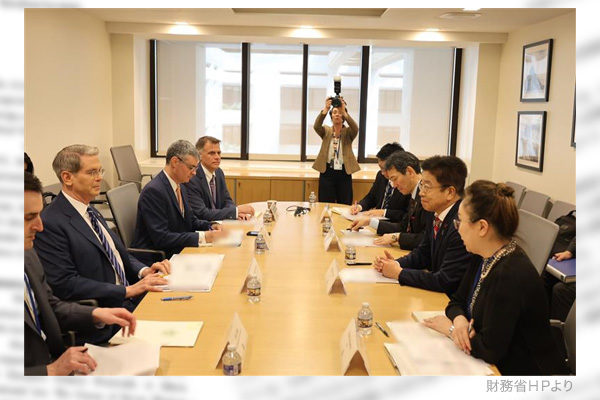

Japanese Finance Minister Katsunobu Kato met with U.S. Treasury Secretary Scott Bessent in Washington on April 24 to discuss exchange rate policy. According to the Japanese side, the ministers reaffirmed their understandings (1) that exchange rates should be determined by the market, and (2) that excessive fluctuations and disorderly movements of exchange rates have negative impacts on economic and financial stability. Although some news media reported that Bessent seemed to have expressed concern about the current dollar-yen exchange rate level to reflect President Donald Trump’s view, the treasury secretary made no specific request such as for setting a target level for the exchange rate. The above two points have been reiterated at meetings of the Group of Seven major countries. The outcome of the Kato-Bessent meeting seems to have been within the scope of Japan’s assumption.

U.S. trade deficits mainly attributable to its economic structure

While insisting that the U.S. dollar as the international key currency must be strong to secure its international credibility, President Trump has emphasized that a strong dollar causes U.S. trade deficits and must be corrected. However, the dollar has fallen from levels above 160 yen in June 2024 to a range of 140-145 yen. If the Trump administration requests the dollar’s further depreciation against the yen, investors in Japan as the largest creditor country may slow down their purchases of U.S. Treasury bonds, destabilizing the Treasury market. This may be one of the reasons why Bessent refrained from requesting Japan to drive up the yen against the dollar further.

In the first place, Trump’s call for correcting a strong dollar is aimed at eliminating U.S. trade deficits. However, Japan’s overall trade balance has already been in deficit, and with respect to the bilateral trade with the United States, Japan’s huge trade surplus is now a thing of the past.

And a country’s trade balance is greatly influenced by a gap between its domestic savings and investment and cannot be determined by exchange rates alone. For instance, if investment exceeds domestic savings in a country, funds will flow into the country from abroad to make up for the savings shortfall, which in turn increases imports and tends to lead to a trade deficit. U.S. trade deficits are attributable mainly to strong investment demand that outpaces domestic savings.

Furthermore, unlike deficits at private companies, a country’s trade deficit simply means imports’ excess over exports and is not any problem. In particular, U.S. dollars provided through U.S. trade deficits function as the international key currency and are important for maintaining stable international liquidity. A U.S. trade balance equilibrium cannot be achieved by high tariffs or a weaker dollar.

It is important to share sound arguments

Bessent, as an investor by trade, has a good understanding of such macro aspects of the economy. However, as long as Trump continues to misunderstand the U.S. trade deficit, the exchange rate issue may be raised at any time. It is not important to adjust U.S. trade through “reciprocal tariffs” or dollar depreciation. In the first place, there is no need to equalize trade at all.

Japan does not need to jump right into concessions to cut a deal with the U.S. It is important for Japan to share sound arguments with understanding individuals like Bessent.

Etsuro Honda is a member of the Planning Committee of the Japan Institute for National Fundamentals and a guest professor at the Kyoto University Graduate School of Management. He formerly served as adviser to the cabinet, advising then Prime Minister Shinzo Abe for the success of Abenomics.