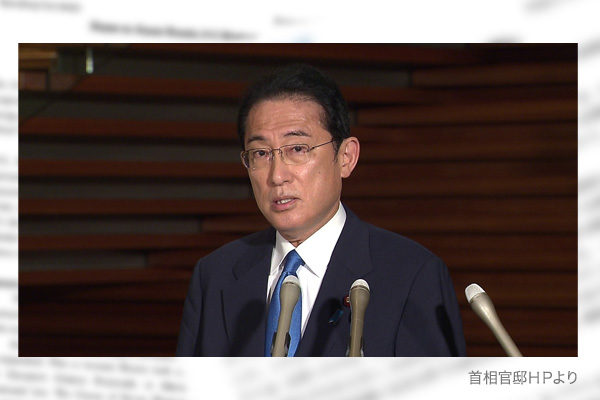

Japanese government under Prime Minister Fumio Kishida has removed a goal of achieving a primary balance surplus in fiscal 2025 from the “Basic Policies for Economic and Fiscal Management and Structural Reform” that lays out the direction for the government’s economic and fiscal policies.

Given an urgent challenge to double defense spending, the removal was a natural choice. But the Ministry of Finance’s intensions to stick to fiscal austerity appear throughout the document. For instance, when formulating a budget for the next fiscal year, the government would adhere to the line of the Basic Policies since 2018 that called for securing financial resources through overall spending cuts and consumer tax increase. If the Kishida administration seriously seeks to enhance defense capabilities and achieve economic revitalization with a “new capitalism,” it should be determined to completely break MOF’ spell for fiscal consolidation.

National finance differs from family finance

The primary balance means the extent to which tax and nontax revenues can cover fiscal spending excluding government debt services to redeem government debt and pay interest on such debt. Behind effectively zero economic growth in Japan in the past quarter century, the government has stuck to the primary balance surplus goal and refrained from promoting investment in future growth. The MOF has retained the primary balance surplus goal as a guidepost for its austere budget policy.

Media often liken national finance to family finance as lectured by the MOF. While a family has no choice but to limit spending to income, national finance completely differs from family finance. If national finance is confused with family finance, national power may decline.

Major fiscal spending items include social security, public works, education and science promotion, and defense. Social security spending supports the stability of national life. All other spending items are indispensable for future productions: public works spending is designed for infrastructure development, education and science spending for human resources development and defense spending for protecting national security from foreign enemies. Investment of financial resources raised through government debt issues can increase national income, or gross domestic product. Under the primary balance constraint, the prime minister may fail to achieve his goals including investment in human resources, decarbonization and a “substantial increase” in defense spending.

No fiscal soundness without economic growth

Japan has roughly remained the world’s largest “money glut” country since the 1990s. At the end of 2021, households had as much as 1,657 trillion yen in net financial assets, covering 709 trillion yen in net government debt and 412 trillion yen in net foreign debt to Japan. According to economic knowledge, a country can sustain a fiscal deficit as long as its economic growth rate tops government bond interest rates. Fiscal crisis can be avoided if GDP expands, as tax revenues will increase and government debt as a percentage of GDP will fall. Fiscal soundness will not be achieved without economic growth.

Hideo Tamura is a Planning Committee member at the Japan Institute for National Fundamentals and a columnist for the Sankei Shimbun newspaper.