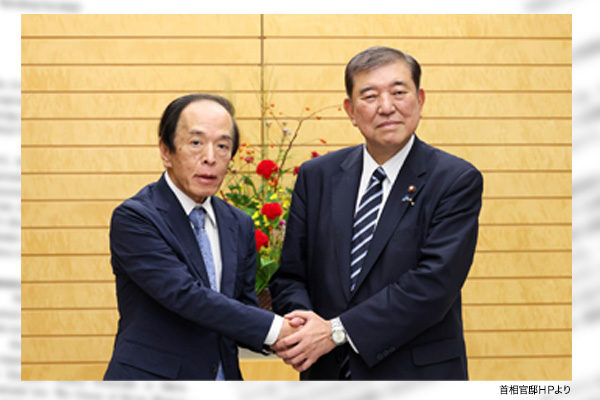

Following his victory in the recent Liberal Democratic Party leader election, Shigeru Ishiba, who had been known for his anti-Abenomics stance, advocated a “breakaway from deflation” and immediately dissolved the House of Representatives as prime minister for a general election. Ishiba should prove after the general election that his sudden change is not merely on the surface.

The new prime minister emphasizes his vow for a “complete departure from deflation” and “wage hikes exceeding inflation.” His remark that the Bank of Japan is “not in an environment for additional rate hikes” has embarrassed market players who knew his earlier adamant call for rate hikes, destabilizing stock prices and the yen-dollar exchange rate.

Discontinued criticism of Abenomics

Since the second half of the 1990s, the Japanese economy has plunged into chronic deflation that has impoverished households and encouraged businesses to give up on the future of the Japanese market and step up investment and production abroad especially in China. Abenomics, or former Prime Minister Shinzo Abe’s economic policy, was the means to get out of these national difficulties. While Abenomics failed to achieve the breakaway from deflation due to two consumption tax hikes, Ishiba turned a blind eye to the terrible aspects of deflation.

In his book titled “Conservative Politician: My Policy, My Mandate,” published by Kodansha on August 7, Ishiba asked what exactly Abenomics was. He not only accused Abenomics of exploiting unprecedented monetary easing to deteriorate national and Bank of Japan finances and of leading low interest rates, a weak yen, and corporate tax cuts to keep alive companies that should have exited, but also doubted the advisability of a growth pass, asking if it is possible to “break away from growth.”

Any idea that the people of Japan, with its declining birthrate and aging population, will become happy without economic growth is nothing more than a fantasy common among Marxists. Growth nurtures children, enables future growth, and supports the lives of the old generation. At the same time, growth helps secure financial resources for the enhancement of defense capabilities. Investment in education, basic research, and technological innovation is essential for sustaining growth. The government’s issuance of bonds to provide fiscal stimulus and the BOJ’s provision of abundant money with zero interest rates are upfront investments to ensure future growth.

Ishiba’s seriousness to be tested in fiscal policy

The seriousness of the Ishiba administration will be tested in fiscal policy. The obsession of the finance bureaucracy that puts austerity first is tremendous. A former top finance ministry official is indignant about the previous Kishida administration, saying: “It implemented the worst lavish spending in history. The Abe administration was still better.” Energy subsidies and fixed-amount tax cuts were cited as some of such spending. Thanks to government spending restraint and substantial tax revenue increase, the government is destined to achieve a surplus in the primary budget balance in FY 2025, excluding new bond sales and debt servicing costs. The Ministry of Finance is not satisfied with the primary budget surplus alone.

Financial bureaucrats will try to achieve a budget surplus, including interest payments on government bonds, when formulating the next fiscal year’s budget after the general election. Will Ishiba be able to resolutely repel their pressure?

Hideo Tamura is a Planning Committee member at the Japan Institute for National Fundamentals and a columnist for the Sankei Shimbun newspaper.