U.S. President Joe Biden is reportedly ready to block Nippon Steel Corp.’s planned acquisition of United States Steel Corp., citing “national security risks.” Republican former President Donald Trump and Democratic Vice President Kamala Harris, both of whom are vying for the next president, also oppose the largest Japanese steelmaker’s takeover of the U.S. steel giant. Prime Minister Fumio Kishida and the ruling Liberal Democratic Party’s presidential hopefuls should protest such unreasonable political interference and emphasize that the deal involves no national security risk as Japan is a staunch U.S. ally. The Committee on Foreign Investments in the United States has so far rejected eight acquisitions by foreign firms for national security reasons, most of which have involved Chinese companies.

Nippon Steel’s high-grade steel manufacturing technology is necessary for the U.S. to compete with Chinese steelmakers that dominate global crude steel production. Currently, U.S. Steel ranks 24th in the world crude steel production, producing 15 million tons annually. By merging with Nippon Steel, the world’s fourth-largest crude steel producer turning out 44 million tons annually, U.S. Steel would come back as the third largest producer in the world. The establishment of supply chains between Japan and the U.S. would greatly contribute to U.S. national security.

Nippon Steel’s rival connected with Biden

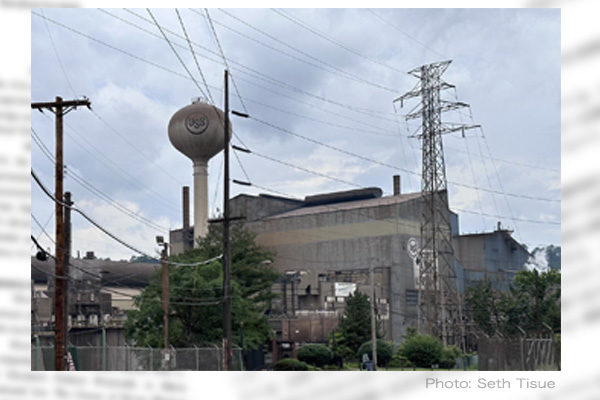

In Pennsylvania where U.S. Steel is based, Governor Josh Shapiro has stated that protecting local jobs is of utmost importance. If so, he should support Nippon Steel’s acquisition of U.S. Steel. In Pittsburgh, Pennsylvania, the birthplace of U.S. Steel, there were many blast furnaces along the Monongahela River. As most of them were closed one after another in the 1970s and 1980s, only three now remain. Still, U.S. Steel employs more than 4,000 people in Pennsylvania.

On September 4, hundreds of U.S. Steel employees gathered in front of the company’s headquarters in Pittsburgh to support its acquisition by Nippon Steel. U.S. Steel Chief Executive Officer David Burritt warned that if the Nippon Steel deal broke down, U.S. Steel plants in Pennsylvania would have to be closed, forcing thousands to lose jobs.

Complaining about the United Steelworkers’ opposition to Nippon Steel’s takeover, the mayor of West Mifflin, a suburb of Pittsburgh, said: “The local citizens and the unions support the takeover. Why are they talking about it without regard to us? “USW representatives speak for Cleveland-Cliffs Inc., another U.S. steel giant, which had failed to acquire U.S. Steel. Cleveland-Cliffs’ CEO Lourenco Goncalves, who is close to President Biden, has expressed his intention to acquire U.S. Steel after Nippon Steel’s takeover is politically blocked and U.S. Steel is dismantled.

Nippon Steel bringing light to U.S. manufacturing

U.S. Steel’s historic Mon Valley Steel Works, built in 1938, is in severe deterioration and will be dismantled. However, Nippon Steel has pledged massive additional investment in modernizing the Mon Valley blast furnace. It has also promised to maintain the name of U.S. Steel and its employees, and pay pensions. The local community has nothing to lose. The Nippon Steel deal is welcomed by overwhelming majority of 98% of U.S. Steel shareholders. Nippon Steel would invest $14.9 billion in the deal, 40% more than U.S. Steel market capitalization at the time of the acquisition agreement.

Nippon Steel’s generous investment would bring high-grade steel manufacturing technology to the U.S. The investment would meet the long-awaited U.S. wish to rebuild Rust Belt factories that produce cars and other finished products. Harris and Trump, who are engaged in a fierce battle to garner votes from blue-collar workers in the U.S. presidential election, should be reminded that Nippon Steel’s acquisition of U.S. Steel would bring light to U.S. manufacturing once again.

Koko Kato is a director at the Japan Institute for National Fundamentals and Managing Director of the National Congress of Industrial Heritage.